IIT is imposed on all individuals, including Chinese and foreign nationals, residing in or deriving income from China.

The comprehensive income is subject to three to 45 percent of progressive rates on the whole.

The employer is responsible for accurately calculating and withholding individual income tax (IIT) on employment income, including but not limited to wages and salaries, bonuses, stock options, and allowances, before paying a net amount to its employee.

This section covers the fundamentals of individual taxation that are imperative for all employers to know before setting up a business.

Taxable income

Under the IIT Law, the following income of an individual shall be subject to IIT:

- Income from wages and salaries;

- Income from remuneration for independent services (20 percent of the income is regarded as deductible expenses);

- Income from the author’s remuneration (20 percent of the income is regarded as deductible expenses, and a further 30 percent discount is available when computing the taxable income);

- Income from royalties (20 percent of the income is regarded as deductible expenses);

- Income from business operation;

- Income from interest, dividends and bonuses;

- Income from lease of property;

- Income from transfer of property; and

- Contingent income.

For resident taxpayers, the first four types of income are consolidated into a new category - comprehensive income and are subject to yearly computation (but employers are still required to compute and withhold the IIT on a monthly basis).

The taxable income amount of comprehensive income of a resident individual shall be the balance after deduction of the standard deduction (RMB 60,000 per year, approx. US$8,500), as well as special deductions, special additional deductions, and other deductions determined pursuant to the law, from the income amount of each tax year.

|

IIT Withholding Rates Table for Resident Individuals |

|||

|

Level |

Taxable income amount subject to cumulative withholding (RMB) |

Withholding rate |

Quick deduction ( RMB) |

|

1 |

≤36,000 |

3% |

0 |

|

2 |

36,000 - 144,000 |

10% |

2,520 |

|

3 |

144,000 - 300,000 |

20% |

16,920 |

|

4 |

300,000 - 420,000 |

25% |

31,920 |

|

5 |

420,000 - 660,000 |

30% |

52,920 |

|

6 |

660,000 - 960,000 |

35% |

85,920 |

|

7 |

>960,000 |

45% |

181,920 |

For non-resident taxpayers, the first four types of income are computed separately per time or per month when it occurs. The taxable income amount for income from wages and salaries of a non-resident individual shall be the balance after the deduction of the standard deduction (RMB 5,000 per month, approx. US$710), as well as other applicable deductions. The IIT rates for non-resident taxpayers are generally equal to those for resident taxpayers.

|

IIT Rates Table for Non-resident Individuals (Monthly) |

||

|

Taxable income amount (RMB) |

IIT rate |

Quick deduction (RMB) |

|

≤3,000 |

3% |

0 |

|

3,000 - 12,000 |

10% |

210 |

|

12,000 - 25,000 |

20% |

1,410 |

|

25,000 - 35,000 |

25% |

2,660 |

|

35,000 - 55,000 |

30% |

4,410 |

|

55,000 - 80,000 |

35% |

7,160 |

|

>80,000 |

45% |

15,160 |

Taxpayers and tax liability

To calculate IIT for an employee, the employer must decide whether an employee is liable for IIT.

The IIT Law divides IIT taxpayers into two categories: resident taxpayers and non-resident taxpayers.

Domestic employees and foreign employees who stayed or are expected to stay in China for at least 183 days are regarded as resident taxpayers, while expatriates who come to China for short-term (less than 183 days) work, such as commercial performance and training, are regarded as non-resident taxpayers.

Resident taxpayers and non-resident taxpayers have different tax liabilities to their income, as summarized below:

|

Tax Liability of Resident Taxpayer and Non-Resident Taxpayer |

||

|

Taxpayer status |

Domicile and residence time |

Tax liability |

|

Resident taxpayer |

Having a domicile in China |

|

|

|

|

|

|

|

|

Non-resident taxpayer |

|

Income sourced in China |

|

Income sourced in China that is paid or borne by domestic employer |

|

Six-year rule

Individuals who do not have a domicile in China will not be required to pay IIT on their worldwide income until they have lived in China for 183 days or more in a year for more than six years in a row. The six-year rule began on January 1, 2019. The number of years before 2019 won’t be included in the six-year count, and individuals with no domicile in China won’t be subject to worldwide income before 2024.

The six-year count can be reset by living in China for less than 183 days in a tax year or by leaving China for more than 30 days in a row where their days of residence in China have reached 183 days in a tax year.

Income sourced in China

The following income shall be deemed income sourced in China, regardless if the place of payment is in China or not:

- Income derived from independent services provided in China due to tenure of office, employment, performance of contract, etc.;

- Income derived from the lease of property to a lessee for use in China;

- Income derived from licensing of various licensing rights for use in China;

- Income derived from the transfer of properties such as immovable property in China or transfer of other properties in China; and

- Income from interest, dividends, and bonuses is derived from enterprises, institutions, other organizations, and resident individuals in China.

As to employment relationship, income sourced in China is defined by 'salary and wages that are related to the individual’s working period in China'.

Under the IIT Law, the working period is counted in days, including actual working days, public holidays, annual leaves, and training days that occurred inside and outside of China during the individual’s China working period.

A day in which a non-domicile person stays in China for less than 24 hours will be counted as 0.5 days when calculating their working period in China. This applies to non-domicile people who are employed by domestic and foreign employers simultaneously or who are employed by foreign employers only but provide work in China and abroad at the same time.

The actual work-time rule does not apply if the individual holds a senior management position in domestic enterprises in China. Their director’s fees, supervisor’s fees, wages and salaries, and other similar income, such as bonuses and stock options paid by the domestic enterprise, shall be regarded as income sourced from China, regardless of whether they work in China.

Tax-exempt income

Under the IIT Law, the following types of individual income shall be exempted from individual income tax:

- Awards for achievements in science, education, technology, culture, public health, sports, environmental protection, etc., granted by the provincial people’s governments, ministries, and commissions under the State Council, units of the Chinese People’s Liberation Army at or above corps level, as well as foreign organizations and international organizations;

- Interest income on treasury bonds and other financial debentures issued by the state;

- Subsidies and allowances issued on a unified basis in accordance with the provisions of the state;

- Welfare benefits, compensation, and relief funds;

- Insurance claims;

- Military severance payment, demobilization pay, and decommissioning pay received by members of the armed forces;

- Settling-in allowance, severance pay, basic pension or retirement pay, retirement allowances, and subsidies given to public servants and workers on a unified basis in accordance with the provisions of the state;

- Income derived by diplomatic representatives, consular officers, and other personnel of embassies and consulates in China, which are exempted from tax in accordance with the provisions of the relevant laws of China;

- Tax-exempt income stipulated in international conventions and executed agreements to which the Chinese Government is a party; and

- Other tax-exempt income stipulated by the State Council.

Deductions

The IIT Law allows several deductions, like, standard deductions, special deductions, special additional deductions, and other deductions determined pursuant to the law, to be deducted from the wage and salaries when calculating the taxable income.

Standard deductions

Standard deduction refers to a fixed amount of money that can be deducted from the individual’s taxable income, which equals to the government’s evaluation of the basic living expenses of the individuals.

The standard deductions for all taxpayers (domestic and foreign employees) are unified to RMB 5,000 per month.

Special deductions

Special deductions refer to the basic social insurance premiums and housing fund contributed by the employee in accordance with the scope and standard stipulated by the laws and regulations.

Each region has their stipulated basic contribution rates. Contributions beyond that might not be pre-tax deductible. For example, although employees are allowed to make additional contributions to the housing fund, it’s not pre-tax deductible for the part over 12 percent of their salary.

Special additional deductions

The IIT system introduced ‘special additional deductions for specific expenditures’ (hereinafter, special additional deductions), which include:

|

IIT Special Additional Deductions in China |

|||

|

Item |

Applicable scope |

Deduction Amount |

Deduction method |

|

Nursing expenses for children under 3 years old |

Nursing expenses |

RMB 2,000/month for each child (or RMB 24,000/year for each child) |

|

|

Children’s education expenses |

Pre-school education Diploma education |

RMB 2,000/month for each child (or RMB 24,000/year for each child) |

|

|

Continuing education expenses |

Diploma education Professional qualification |

RMB 400/month, up to 48 months (or RMB 4,800/year, up to four years) RMB 3,600 in the year when the related certificate was issued |

|

|

Healthcare costs for serious illness |

Expenses recorded in the social medical insurance management system |

Maximum RMB 80,000 based on actual basis |

|

|

Housing loan interest |

First housing loan under taxpayer or spouse’s name |

RMB 1,000/month up to 240 months (or RMB 12,000/year, up to 20 years) |

|

|

Expenses for supporting the elderly |

Parents over 60 years old Other legal dependent |

RMB 3,000/month (or RMB 36,000/year) |

|

|

Housing rent |

The taxpayer and spouse do not have a house in the city where they work |

Three applicable deduction amounts based on working locations:

|

|

Tax-exempt fringe benefits for foreigners

The Chinese tax bureau currently allows foreign employees to deduct certain fringe benefits before levying the tax on their monthly salary. It’s common practice that companies structure part of their foreign employee’s salary as fringe benefits.

Generally, the below allowances are deductible:

- Housing expense;

- Meal fee;

- Laundry fee;

- Education expense for children;

- Language training expense;

- Relocation expense;

- Business travel expenses; and

- Home visit expense.

Not all companies can use these allowances to help their foreign employees save tax. This is because the tax bureau has certain discretion to reject tax-exempt applications where the employer has in-compliant tax records. Companies are suggested to consult with the tax bureau in charge in advance.

To attract and retain foreign talent, the Ministry of Commerce and the State Taxation Administration jointly extended China’s preferential IIT policy on foreigners' fringe benefits until December 31, 2027.

Other deductions determined pursuant to the law

The IIT Law allows certain other deductions, such as payment by an individual for enterprise annuity and occupational annuity, which comply with state provisions, expenditure of an individual for purchase of commercial health insurance and tax-deferred commercial pension insurance which comply with State provisions, and other deductible items stipulated by the State Council.

IIT calculation

For resident individuals

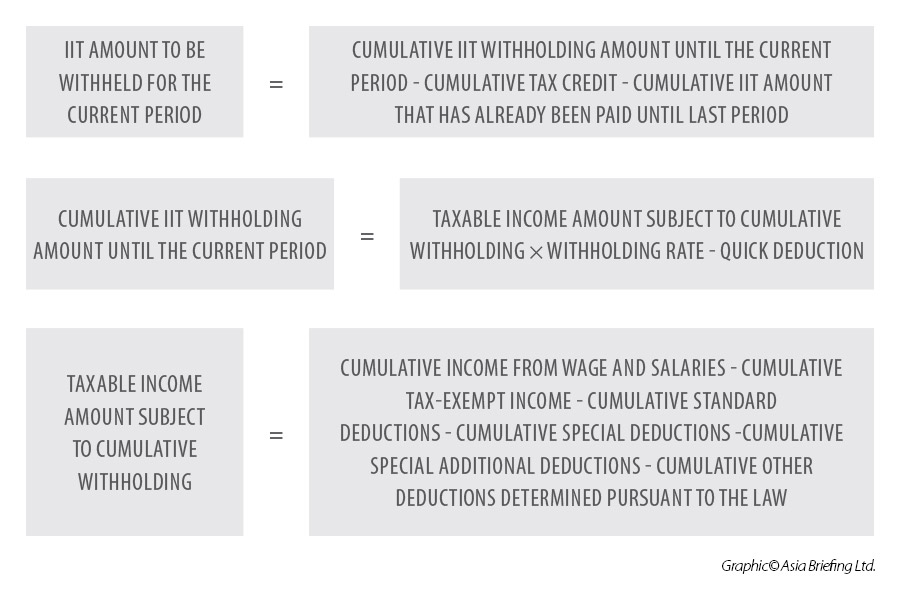

When a company pays wages and salaries to an employee who is regarded as a resident individual, it must compute the IIT amount using the ‘cumulative withholding method’ and withhold and report the IIT on a monthly basis.

Under the cumulative withholding method, the ‘IIT amount to be withheld for the current period’ should be the balance of the ‘cumulative IIT withholding amount until the current period’, with the ‘cumulative tax credit’ and the ‘cumulative IIT amount that has already been paid’.

To calculate the cumulative IIT withholding amount until the current period:

- Calculate the taxable income amount subject to cumulative withholding by deducting various items – including the cumulative tax-exempt income, the cumulative standard deductions, the cumulative special deductions, the cumulative special additional deductions, and cumulative other deductions determined pursuant to the law – from the taxpayer’s cumulative income from wages and salaries for the tax year derived from employment up to the current month; and

- Apply the applicable withholding rates and quick deductions stipulated in the IIT Withholding Rates Table for Resident Individuals.

Where the IIT amount to be withheld is negative, a tax refund will not be made in the interim. Where the balance amount at the end of the tax year is still a negative value, the taxpayer will, through completing annual tax reconciliation for consolidated income, obtain a tax refund for excess tax paid and make retrospective payment if there is underpaid tax.

For non-resident individuals

When a company pays wages and salaries to a non-resident individual, it is required to withhold and report IIT on a monthly basis, or for each payment, in accordance with the following methods:

- Calculate the taxable income amount by lessening standard deduction (RMB 5,000) and other deductions – special additional deductions (where it is applicable), tax-exempt fringe benefits (where it is applicable) – from the non-resident taxpayers’ monthly income amount liable to Chinese IIT;

- Apply the applicable tax rates and quick deductions stipulated in the IIT Withholding Rates Table for Non-resident Individuals.

Annual reconciliation

Resident taxpayers are required to make a settlement during the period between March 1 and June 30 of the following year.

This mechanism applies specifically to the following scenarios:

- Taxpayers deriving comprehensive income from two or more sources, and the balance after deducting special deductions from the amount of annual comprehensive income exceeds RMB 60,000;

- Taxpayers deriving one or more items of comprehensive income from labor services, author’s remuneration or royalties, and the balance after deducting special deductions from the amount of annual comprehensive income exceeds RMB 60,000;

- Taxpayers deriving comprehensive income, and the total tax paid in monthly IIT filings within a tax year is less than the tax payable amount; and

- Taxpayers derive comprehensive income and can apply for a tax refund.

IIT declaration and filing

IIT declaration

Taxpayers are required to make an IIT declaration upon emigration.

We have detailed the circumstances under which taxpayers need to make a tax declaration below:

- The taxpayer obtains taxable income, but there is no withholding agent;

- Non-resident individual derives income from wages and salaries from two or more sources in China;

- Taxpayer obtains comprehensive income and needs to process annual tax reconciliation;

- The taxpayer obtains taxable income, but the withholding agent does not withhold tax;

- Taxpayer obtains overseas income;

- Taxpayer has migrated overseas and cancelled his/her household registration in China; or

- Any other circumstances stipulated by the State Council.

IIT filing

The employer is required to make IIT filing within the first 15 days of the month following the tax withholding either through the IIT system online or submit a Filing Form for Individual Income Tax Withholding to the Tax Bureau in charge.

When the employer pays income to a taxpayer for the first time, it shall complete an Individual Income Tax Basic Information Sheet (Form A) based on basic information such as tax ID provided by the taxpayer and submit it to the tax authorities at the time of tax filing in the following month.

Preferential IIT policies in special regions

To lower the IIT rate and offset the difference with Hong Kong, nine mainland GBA cities have introduced IIT subsidies from 2019 to 2023. During this period, the portion of the IIT that exceeds 15 percent of the taxable income paid to qualified overseas talent will be refunded as fiscal subsidies.

China Annual IIT Reconciliation – Your Tax Owed Payment FAQs Answered

I am a foreigner and worked in China for the entirety of 2020. I worked less than one year in 2021, leaving China at the end of March 2021. My salary was RMB 10,000 per month for the whole time. Will this situation have an impact on my 2021 IIT calculation and payment? Does this situation involve tax return or tax owed? How should I file it?

There are two kinds of tax identity for foreigners working in China, each with its own calculation method.

Simply put, those who stay in China for more than 183 days will be regarded as resident individuals, while those who stay less than 183 days will be regarded as non-resident individuals. The company where the foreigner is an employee will evaluate and estimate the expat's ‘days in China’ and choose the tax identity at the beginning of the year.

In your case, you were originally regarded as a resident individual in terms of your tax identity in 2020 (the cumulative period in China is more than 183 days in 2020). In 2021, you stayed in China for less than 183 days. Hence your tax identity shall switch from resident individual to non-resident individual.

As the calculations for the two tax identities are different, it is possible to have tax owed. IIT is calculated on accumulated salary for resident individuals and shall use the annual comprehensive tax rate. Resident individuals are generally subjected to lower tax rates at the first few months of the year and then subject to higher tax rates later in the year as accumulated salary mounts up. IIT for non-resident individuals is calculated on each month’s salary and shall use the monthly comprehensive income tax rate.

So, in the withholding stage, you were regarded as a resident individual and subjected to a three percent lower tax rate. The total IIT payable was RMB 450. However, your IIT shall be recalculated based on the method for non-resident individuals, and you shall be subjected to a higher tax rate of 10 percent. So, the total IIT payable shall be RMB 870. Hence the tax owed of RMB 420 is attributed to the shift of tax identity.

|

Month |

Income (RMB) |

IIT for non-resident individuals (RMB) |

Tax rate |

IIT for resident individuals (RMB) |

Tax rate |

|

January 2021 |

10,000 |

290 |

10% |

150 |

3% |

|

February 2021 |

10,000 |

290 |

10% |

150 |

3% |

|

March 2021 |

10,000 |

290 |

10% |

150 |

3% |

|

In total |

30,000 |

870 |

10% |

450 |

3% |

Under these circumstances, you should report to the competent tax authority within the period from the day on which he/she fails to satisfy the resident individual criteria to 15 days from the end of the year. Your IIT will be recalculated, and all the tax owed has to be settled.

I am a foreigner working for Company A (in China) in the first half of 2021 with a monthly salary of RMB 10,000, and worked for Company B (in China) in the second half of 2021 with a monthly salary of RMB 15,000. Is it possible that I have tax owed?

Companies serve as the withholding agents and will withhold tax monthly.

When you switch to Company B, Company B shall assume July 2021 as the starting month of your income. Without aggregating your income from Company A, your accumulated income was zero when Company B started calculating your IIT, and you were subjected to a lower tax rate.

At the annual IIT reconciliation, your income from both Company A and Company B shall be combined for calculation, and you shall be subjected to higher tax rates and be required to pay the tax owed. The calculation is demonstrated below.

When Company A and Company B were calculated separately, the withheld IIT in total was RMB 4,380:

|

|

Monthly income (RMB) |

Number of months |

Total income (RMB) |

Total deduction (RMB)* |

Taxable income (RMB) |

IIT |

Tax rate |

|

Company A (January to June 2021) |

10,000 |

6 |

60,000 |

30,000 |

30,000 |

900 |

3% |

|

Company B (July to December 2021) |

15,000 |

6 |

90,000 |

30,000 |

60,000 |

3,480 |

10% |

|

In total |

|

|

|

60,000 |

90,000 |

4,380 |

|

*Here, we only take into account the standard deduction, which is RMB 60,000 per year. In practice, it’s possible that there will be other kinds of deductions, such as special deductions (the individual’s social insurance and housing fund contributions), special additional deductions (children’s education, continuing education, serious illness medical treatment, housing loan interest or housing rent, expenses for elderly support, etc.), or the tax-exempt fringe benefits for foreigners.

After IIT reconciliation, the recalculated IIT payable is RMB 6,480:

|

|

Amount (RMB) |

|

Company A's taxable income |

30,000 |

|

Company B's taxable income |

60,000 |

|

Total taxable income |

90,000 |

|

IIT payable |

6,480 |

|

Tax rate |

10% |

That is to say, the tax owed of RMB 2,100 needs to be paid.

I am a foreigner. I worked for Company A in 2021; my monthly salary was RMB 20,000. I also provided labor service to Company B for the whole year, and my monthly service fee was RMB 20,000. Is it possible that I have tax owed?

Yes, wages and salaries, labor remuneration, author’s remuneration, and royalties are declared separately in the withholding stage but shall all be combined into comprehensive income in the final IIT reconciliation. After the combination, you might be subjected to a higher tax rate.

In the withholding stage, Company A withheld IIT for salary, and Company B withheld IIT for labor service separately. The two companies withheld RMB 57,480 IIT in total.

|

IIT on Salary Income from Company A |

|

|

Monthly income (RMB) |

20,000 |

|

Total income (RMB) |

240,000 |

|

Deduction (RMB) |

60,000 |

|

Taxable income (RMB) |

180,000 |

|

Total IIT withheld (RMB) |

19,080 |

|

Tax rate |

20% |

|

|

Service Fee Withheld by Company B |

|

Monthly service fee paid (RMB) |

20,000 |

|

Deduction per month (RMB) |

4,000 |

|

Taxable income per month (RMB) |

16,000

|

|

IIT per month (RMB) |

3,200 |

|

Total IIT for the service fee (RMB) |

38,400 |

|

|

20% |

In the annual IIT reconciliation, the taxpayer is taxed by aggregating both salary income and income from labor service every year. Incomes are combined and subjected to a higher tax rate of 25 percent. For the whole year, the IIT payable is RMB 61,080.

You shall be required to pay tax owed of RMB 3,600.

|

|

Amount |

|

Taxable income from labor service (RMB) |

16,000*12=192,000 |

|

Taxable salary income (RMB) |

180,000 |

|

Total Taxable comprehensive income (RMB) |

372,000 |

|

IIT payable in total (RMB) |

61,080 |

|

Tax rate |

25% |

What are the consequences if the tax owed is not paid within the time limit? If there was an overdue tax payment of the 2020 annual IIT reconciliation, would it affect my annual IIT settlement for 2021?

If the individual fails to complete the annual IIT reconciliation and payment on time (i.e., before June 30 every year unless it is otherwise stipulated), the tax authority will send a reminder. Where the circumstances are serious, the individuals might be held accountable, and this will be documented on the individuals’ personal tax credit files.

Also, individuals failing to settle their taxes owed in time will need to pay a late fee at the daily rate of 0.05% and may be subject to additional fines.

Such individuals are not eligible for the 2021 annual IIT reconciliation before they complete the 2020 annual IIT reconciliation and pay the tax owed.

Any final recommendations?

Annual IIT reconciliation is one of the most common topics of concern and confusion among individual taxpayers. Individual taxpayers are recommended to make the annual IIT settlement before the required deadline. Taxpayers who have taxes owed are recommended to pay the tax owed in time according to relevant regulations to avoid unnecessary late fees, fines, and the negative impact on their personal credit record.