Why is ERP Important for Operating a China Business?

ERP adoption is rapidly gaining traction in China as a strategic tool to navigate market uncertainties and promote organizational efficiencies in the aftermath of COVID-19. A number of ERP deployment options are accessible to firms operating in China, and these can be tailored to meet the requirements of diverse businesses, irrespective of their scale.

Doing business in China has changed dramatically in the past few years. With the uneven recovery of the Chinese economy, rising geopolitical risks, and evolving tax and data compliance regimes – both in China and globally – companies are operating in an increasingly complex environment.

Yet, the China operations of many organizations provide unparalleled access to one of the world’s largest and most competitive global supply chains. This presents the informed executives of these companies with significant opportunities to retain and build on their own comparative advantage by optimizing their operations in the country.

Given this context, ERP systems are increasingly favored by international companies in China, as they provide a range of advantages not only to those expanding in the region but also to businesses optimizing their operations and building supply chain resilience.

That said, many companies, particularly small and medium-sized ones, may still hesitate to adopt ERP systems due to traditionally perceived high costs and overseas implementation challenges. Despite these concerns, various pathways exist in China for affordable and compatible ERP deployments for companies of any size. There are also options for one-stop software-as-a-solution (SaaS)-like ERP services, which offer smaller businesses a more streamlined, cost-effective, and efficient approach to access integrated processes, without making substantial investments.

In this article, we explain why ERP is essential to power your China operations and guide you in choosing the right ERP approach for your business.

What is ERP?

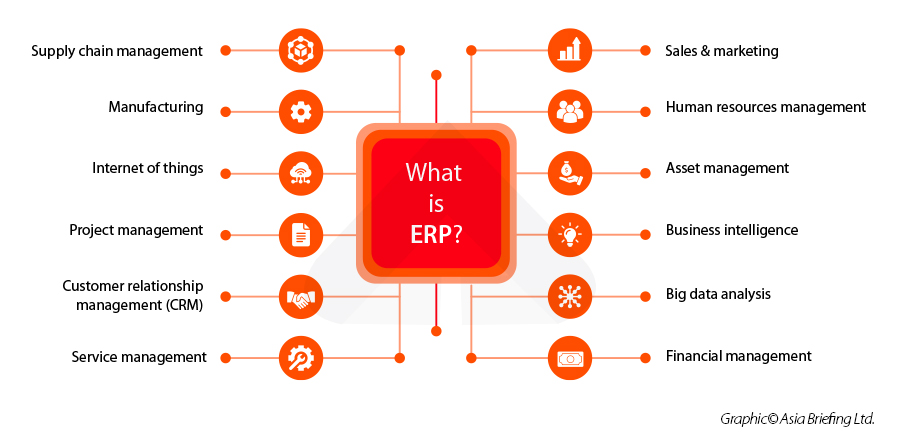

ERP, short for Enterprise Resource Planning, is a software system designed to assist businesses in managing a range of essential elements, including but not restricted to materials, equipment, employees, capital, products, and clients. By integrating core business processes and unifying data from diverse sources, an ERP system can empower businesses to oversee these resources via a unified, company-wide system. This results in streamlined operations, enhanced insights, and optimal performance across an organization.

An ERP system can cover anything from financial management and human resources management to supply chain management, operations, manufacturing, and even customer relationship management. That said, not every company needs to utilize every module – businesses can choose what to use based on their business type, size, and development stage, and other criteria.

Why is ERP important for your China success?

Increased need for flexibility, control, and compliance

Despite the economic fluctuations and challenges faced by international companies in recent years, China remains resolute on its path to recovery. While some businesses explore reshoring, near-shoring, or diversifying their global strategies by moving capital elsewhere, those with established operations in China are committed for the medium to long term. Many recognize the unfolding opportunities and incentives within China, positioning it as a pivotal hub in their broader Asia strategies. These companies now prioritize operational flexibility, efficiency, control, and compliance as key drivers for sustained success.

In this context, the impetus to enhance management capabilities and elevate performance within China and across Asia has regained prominence. Consequently, companies are once again intensifying their internal efforts to implement ERP systems in their China and Asia-based operations.

Positioning to expand or scale operations with higher productivity and performance.

When businesses scale up in China and emerging Asia, they frequently experience operational growing pains. Existing software often falls short in handling increased workflows, workforce capabilities, and compliance requirements. Here, an ERP system steps in, ensuring that company growth doesn’t hinder internal processes or customer experiences.

To be more specific, the implementation of an ERP system can optimize business management in the following areas:

Push from investors/global headquarters for better control and transparency

Another impetus for a company’s ERP initiative might arise from the insights gained by investors and global headquarters, driven by a desire to enhance their understanding and oversight of their China operations.

Reflecting on the time when China enforced stringent border restrictions to curb the spread of COVID-19, investors and global headquarters found themselves with limited avenues to verify and corroborate the information they received from their China-based personnel via emails or calls. This situation exposed them to risks like fraud and irregularities, resulting in lax employee management and ineffective internal controls.

This experience could serve as a catalyst for investors and headquarters to expedite the ERP implementation process. Notably, ERP stands out as a tried-and-true instrument to bolster control and transparency across multi-country operations, in tandem with improved reporting mechanisms.

Increasing complexity in compliance and business management

Apart from streamlining business processes and improving control, both overseas headquarters and China-based operations might contemplate ERP implementation to address the increasing complexities of domestic and international compliance, as well as overall business management. Several notable factors are gaining prominence, including:

- Continuous digitalization of China’s tax administration – the Chinese tax bureau has endeavored to achieve advanced tax administration through digitalization and intelligent transformation. Recent efforts include the implementation of fully digitalized e-fapiao (e-invoice) and the introduction of the Golden Tax System Phase IV. Under this trend of tax digitalization, businesses are exposed to bigger tax risks as the tax bureau’s ability to spot non-compliant tax behavior will be enhanced by big data technology.

- China’s complicated and evolving legal frameworks – China has uniform laws and regulations at the national level, but there are local variances during implementation. Moreover, the country has undergone continuous business reforms since the 2010s. These reforms aim to enhance the business environment and facilitate investment broadly, yet they also result in frequent adjustments to China’s legal structures, affecting short-term predictability. Collectively, these factors compound the challenges of compliance in China.

- Adjustment of global supply chains – there is an accelerated trend of supply chain diversification and restructuring amid rising geopolitical tensions with Western countries. Businesses have good reasons to consider resilience a high priority now over cost efficiency and quality. Further, a diversified supply chain also means engagement with China suppliers and vendors may become even more complicated.

- New reporting and data accounting requirements arising from the BEPS 2.0’s “Two Pillars” – the OECD has issued the final implementation guidance for pillar two of the BEPS 2.0 initiative, paving the way for establishing a global minimum tax rate of 15 percent by 2024. Alongside the prerequisites for computing a multinational enterprise’s effective tax, there’s a spectrum of additional evaluation and data reporting mandates, including those delineated in Chapter 8 of the GloBE Rules and the GloBE Information Return rules. Businesses must adeptly and resourcefully capture the requisite data at the group level to ensure compliance.

In this continually evolving landscape marked by various technical and systemic changes and legal reforms, businesses need to be constantly prepared to adjust. They must attain a deeper understanding of their operations, enhance control, expedite decision-making, and respond swiftly and adeptly to obstacles. This is precisely where ERP steps in to empower businesses to achieve these goals.

Choosing a suitable path to ERP for your China business

While many enterprises have already established a global ERP brand and system of their preference for localization in China, others adopt a more flexible approach on a country-by-country basis. In both scenarios, multiple viable paths and options come into play when determining the optimal approach for ERP deployment in China.

A common challenge faced by companies during ERP selection is whether to adhere strictly to the global system standard or opt for a solution that aligns more closely with local practices. This deliberation often takes center stage in internal discussions.

A significant number of enterprises lean toward extending their existing global ERP system, which is already operational across other worldwide entities, into China. These companies choose not to set up a separate ERP system solely for their Chinese operations. Success with this approach involves localizing the corporate global ERP to suit the specific context of their Chinese business.

Although many organizations have achieved positive outcomes using this strategy, some encounter resistance or hurdles raised by their local management teams in China. Common concerns expressed by these teams include issues related to regulatory compliance, language barriers in the user interface, and compatibility of integrations with tax, banking, and external third-party entities.

Navigating these challenges can make ERP decision-making complex, and some companies find themselves at an impasse. Overcoming local apprehensions may necessitate adjustments in approach, along with well-informed technical or regulatory explanations to address doubts and concerns. Fortunately, these obstacles are often surmountable with the knowledge and expertise available to guide the planning and implementation process.

Yet different circumstances could warrant different approaches. In some instances, opting for a stand-alone ERP system specifically tailored for China operations can be both logical and valuable. his approach might serve as a permanent solution, especially if the operations are relatively small and distinct. Alternatively, it could be a strategic interim step. Notably, many local ERPs can later be seamlessly integrated with the global ERP system, provided this consideration is factored into the initial design stage.

To make an informed decision on the optimal ERP pathway, each company should assess its initial requirements and seeking guidance from on-the-ground experts regarding essential local considerations, advantages, and potential drawbacks. Often, leveraging insights from a third-party with local expertise proves advantageous for companies embarking on this journey.

In the remaining parts of this section, we overview and then take a deeper look at different ERP strategies with a brief assessment of their value and limitations.

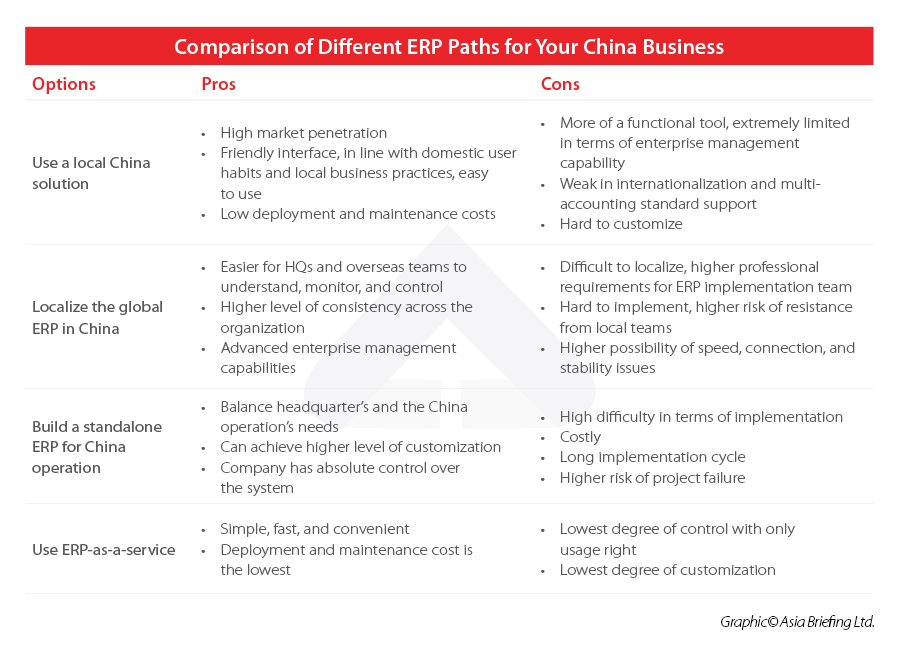

Path 1: Use a local China solution

This option is often recommended by China teams. The predominant ERP tools employed in China remain Kingdee/K3 and YongYou/UFIDA.

Initially catering solely to accounting and finance, these local ERP solutions have deep roots in China and are well known to accountants. They offer features and interfaces aligned with local business practices and user preferences, with comparatively lower initial deployment and maintenance costs.

However, these local solutions are primarily available in the Chinese language and are severely limited in terms of enterprise management capabilities. They primarily serve compliance and basic organizational management needs. Moreover, these solutions are geared primarily towards Chinese customers and still lag behind major international players in terms of internationalization and support for multi-accounting standards. Thus, while they have progressed significantly from the basic software of a decade ago, they still fall short of being a comprehensive solution for many global companies.

This option is most suitable for businesses whose primary purpose for ERP implementation is basic compliance and organizational management in China. It’s particularly suitable for those with limited customization and internationalization demands.

Path 2: Localize your global ERP

Expanding the existing global ERP system to China and applying requisite localization adjustments to align with local business practices and mandatory specifications is a choice that headquarters and overseas teams are inclined to favor.

Operating within the same system facilitates headquarters and overseas teams to understand the relevant data gathered and reports generated, as well as to monitor, manage, and control relevant business processes. Consequently, a higher level of consistency can be achieved across the organization using this approach. Moreover, a mature ERP system with advanced enterprise management capabilities can also help to standardize and optimize the management of local operations to a large extent.

On the other hand, the localization process is not easy. Not only does the ERP system need to accommodate localization, but the expertise required from the ERP implementation team is also demanding. They need to be proficient in the software itself, the mandatory localization requirements (language, accounting standard, reporting rules, etc.), as well as relevant business processes of different industries and local user habits. Plus, depending on the software and deployment situation, this option often presents more problems regarding speed, connection, and stability during actual usage. To ensure seamless implementation, companies and their IT service providers must thoroughly grasp these issues and devise pertinent solutions from the outset.

This option is most suitable for those whose main purpose of ERP implementation is

to improve transparency and trust between the headquarters and China operations and bring the enterprise management capability of the China operation to the international level and group standard. This decision must be complemented with having a competent internal IT team or reliable third-party professionals for effective ERP localization and to generate follow-up maintenance supports.

Path 3: Build a standalone ERP for China operation

Some businesses may decide to build a standalone ERP for their China operations. This option can take into account the needs of the headquarters and the China team during the whole deployment process and achieve a higher degree of customization, as the system is specially developed for the project. Also, the company will have absolute control over the ERP system.

But it’s also an option that is very difficult to implement, with high costs, long turnaround time, and a higher risk of project failure, especially when the overseas team and local operations have conflicted opinions over any key decisions during the configuration and deployment process.

This option is most suitable for those who have adequate budget and time for the ERP deployment. They usually have high customization requirements and require absolute control over the local operation’s ERP system and data generated.

Path 4: Use ERP-as-a-service: A ready-built, one-stop ERP solution

The one-stop ERP-as-a-service solution sidesteps the need to build or implement your own system in China, and instead extends already built and hosted ERP system capabilities, from a service provider’s cloud computing platform to your business. The functionalities of an ERP are delivered to users via the Internet, and the user company pays for the ERP service through an annual or monthly subscription model. This model is inherently known as SaaS ERP.

Within this option, capabilities can be pre-packaged or customized to suit the organization’s needs and often offer a much quicker path to managing a company’s accounting and other business areas through modules provided by professional ERP services. Meanwhile, the provider/vendor is responsible for configuring, maintaining, upgrading, data storage, and securing the ERP system. Consequently, this option boasts rapid implementation, cost-efficiency, accessibility, advanced performance, enhanced security, and continuity.

However, this choice may lack robust support for extensive customization. Companies may be constrained to use the standard functionalities offered by the ERP-as-a-service provider, or else the cost-efficiency advantage will be affected. Additionally, while the generated data remains the property of the user company, their control over the ERP system and the data is relatively limited, as they possess usage rights rather than full ownership.

This option is well-suited for small enterprises scaling up, and who seek the advantages of integrated businesses processes to optimize their operations without costly and complex setups.

Dezan Shira & Associates’ Client-ERP service helps customers realize optimized financial and management processes without costly and complex setups. Hosted on secure infrastructure, our Client-ERP is maintained by our team of IT and finance experts, and can be integrated with global ERP and local party systems. To arrange a free consultation, please contact china@dezshira.com.

(This article was originally included in the China Briefing magazine August 2023 issue: Empowering Your China Business with Successful ERP Implementation.)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Investing in China’s Multi-Billion-Dollar Pet Industry – Mongolia’s Opportunity to Shine

- Next Article China Q3 2023 Economic Roundup: GDP Growth Beats Forecasts