Hainan Unveils First Zero Tariff Positive List, Allows SOEs to List Overseas

- Starting December 1, 2020, certain raw and auxiliary materials imported by independent legal entities registered in Hainan for the entities’ own production or for processing trade or service trade activities “with both ends abroad” (importing materials for exporting the final product/service) can be exempt from import duties, import value-added tax, and import consumption tax.

- The zero-tariff raw and auxiliary materials are subject to positive list management. The positive list covers agricultural products, resource products, chemicals, optical fiber preforms, and components for the maintenance of aircrafts and ships.

- The positive list for zero-tariff raw and auxiliary materials is one of the four lists (one negative and three positive) under Hainan Free Trade Port’s “zero tariff” policies. With the publication and implementation of the first list, the other three are expected to be released in the near future.

- In addition, Hainan authorities on November 27 allowed state-owned enterprises (SOEs) in Hainan FTP to list securities on foreign stock exchanges.

On November 12, 2020, three Chinese authorities – the Ministry of Finance (MOF), the General Administration of Customs (GAC), and the State Taxation Administration (STA) – released the Notice on “Zero Tariff” Policies for Importing Raw and Auxiliary Materials to Hainan Free Trade Port (Cai Guan Shui [2020] No.42).

According to the notice, raw and auxiliary materials on the positive list imported to Hainan Free Trade Port (FTP) can be exempt from import duties, import value-added tax (VAT), and import consumption tax (CT), if:

- The applicant is an independent legal entity registered in Hainan FTP; and

- The raw and auxiliary materials are imported for:

- Production for self-use;

- Production and processing activities “with both ends abroad” – the final products will be exported to overseas markets; or

- Service trade activities with both ends abroad.

This “zero tariff” policy came into force December 1, 2020 and will be effective till 2025 when island-wide independent customs operations are implemented.

What is in the positive list of zero-tariff raw and auxiliary materials?

The zero-tariff raw and auxiliary materials are subject to positive list management, which means that only materials covered by the positive list can be exempt from import taxes (you may find the English version of the full list here – but what must be noted is that the list will be dynamically adjusted by relevant departments, according to the practical demand and regulatory conditions of Hainan).

The full positive list has a total of 169 items, all with different eight-digit HS codes, covering agricultural products (like coconut and barley), resource products (like ore, coal, crude oil, liquefied natural gas, and wood), chemical raw materials (like xylene, methanol), optical fiber preforms, and aircraft and ship maintenance spare parts. Among them, the spare parts for aircraft and ship maintenance must meet the relevant conditions before tax exemption can be applied.

Business opportunities and considerations under the zero tariff policy

The zero tariff policy for imported raw and auxiliary materials is conducive to saving operating costs and capital costs of manufacturing and processing enterprises, and will benefit the development of sectors like aviation, aircraft maintenance, ship maintenance, and processing and assembly.

On December 1, Hainan Airlines Holding Co., Ltd. imported a batch of meteorological radar transceivers worth of RMB 3.8 million (US$580,000) and is expected to become the first company to enjoy the zero tariff policy. According to reporting by Xinhua, the imported meteorological radar transceivers, after customs clearance, could enjoy a tax exemption of RMB 530,200 (US$80,687).

To enjoy this tax exemption policy, however, entities should note that there are also restrictive conditions.

The Notice stipulates that the imported zero-tariff raw and auxiliary materials are only for production or use by a Hainan-registered entity, are subject to customs supervision, and cannot be transferred within or out of the island. If the entity wished to transfer the zero-tariff materials or the products manufactured with zero-tariff materials to other entities within the island, or sell them to the Chinese mainland, it has to pay taxes and go through necessary customs formalities.

Thus, before importing materials, it is advisable that entities understand well how they are going to use the materials and where the final products will be sold to.

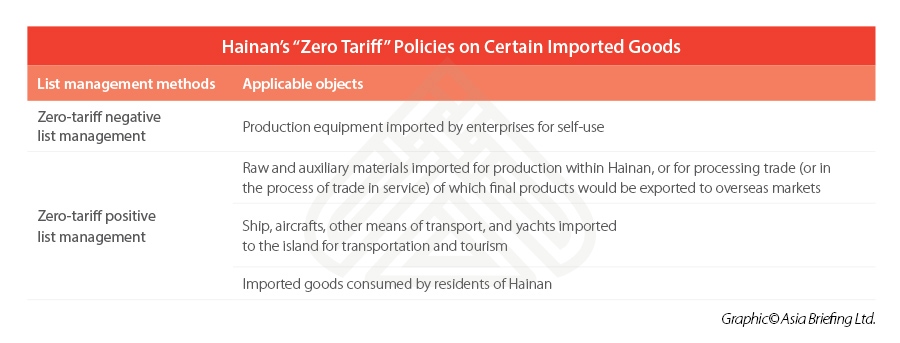

Background – zero tariff policies on certain imported goods

On June 1, 2020, China released the Overall Plan for the Construction of Hainan FTP, which unveiled the roadmap for Hainan to be developed into a world-leading free trade port and set out a series of preferential policies, including the zero tariff policies on certain imported goods.

According to the Plan, China aims to launch island-wide independent customs operations and implement a simplified tax regime in Hainan by around 2025. After that time, all imported goods – except for goods listed in the to-be-formulated Negative List of Commodities Subject to Import Taxes and goods prohibited from importing into Hainan by law – will be exempt from import duties.

Before the island-wide customs closure and operations, some imported goods subject to list management can be exempt from import duties, import VAT, and import CT. These goods include production equipment imported by enterprises for self-use (negative list), raw and auxiliary materials imported to Hainan under certain conditions (positive list), ship, aircrafts, other means of transport, and yachts imported to the island for transportation and tourism (positive list), and imported goods consumed by residents of Hainan (positive list).

All the lists will be dynamically adjusted by relevant departments, according to practical demand and regulatory conditions of Hainan. And, with the first positive list for raw and auxiliary materials being published and implements, we can expect that the remaining lists will be released in the near future.

Hainan allows national companies to list shares overseas

On November 27, 2020, the State Administration of Foreign Exchange (SAFE)’s Hainan bureau issued the Administrative Measures for Pilot Registration of Overseas Listing of Companies in the Hainan FTP, allowing state-owned enterprises (SOEs) in Hainan FTP to publicly issue and trade securities at a foreign stock market after seeking approval from China Securities Regulatory Commission (CSRC).

The Measures took effect as of the date of promulgation. SOEs registered in Hainan can make, change, or cancel registrations of overseas share listings at banks under the jurisdiction of Hainan bureau of the SAFE. The policy is China’s latest move to actively involve Hainan in global trade and business, and to attract foreign capital.

Dezan Shira & Associates has been paying close attention to the development of Hainan FTP and its preferential policies on trade facilitation, import and export duties, customs supervision, and financial reforms. For more information, please contact us for assistance at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Schritte zum Schutz Ihres Unternehmens vor Phishing-Angriffen

- Next Article Sfruttare le nuove opportunità dell’agroalimentare nel mercato cinese