What Can the Newly Approved ETF Connect Between Mainland China and Hong Kong Bring to Foreign Investors?

China is on the move to open more of its financial market. Recent official statements in late May vowed to facilitate the ETF Connect program with Hong Kong, after long delays, and attract more foreign investors to its onshore market. The efforts aim to attract more capital into the region and reignite interest in the RMB amid an economic slowdown.

On May 27, 2022, the China Securities Regulatory Commission (CSRC) and the Hong Kong Securities and Futures Commission (SFC) announced in a joint statement that Exchange-Traded Funds (ETFs) will be included in the “Stock Connect” program. This will allow investors to trade eligible ETFs listed on both the Chinese Mainland and Hong Kong exchanges by using local securities firms or brokerages.

The statement also suggests a two-month preparation period before the launch to finalize trading and clearing rules and systems, obtain regulatory approvals, and adapt market participants to the operational and technical systems.

This inclusion also marks the realization of the “ETF Connect” idea, initially proposed in 2016, after long delays. The program will expand trading connections between the mainland and Hong Kong, furthering the opening of China’s financial market to the world.

What are the Stock Connect and ETF Connect?

China has long been working to link its financial markets to others. China launched the Shanghai-Hong Kong Stock Connect in 2014 and the Shenzhen-Hong Kong Stock Connect in 2016, to connect the Hong Kong Stock Exchange with the mainland market. Under the program, investors in each market can trade shares on the other market using their local brokers and clearinghouses.

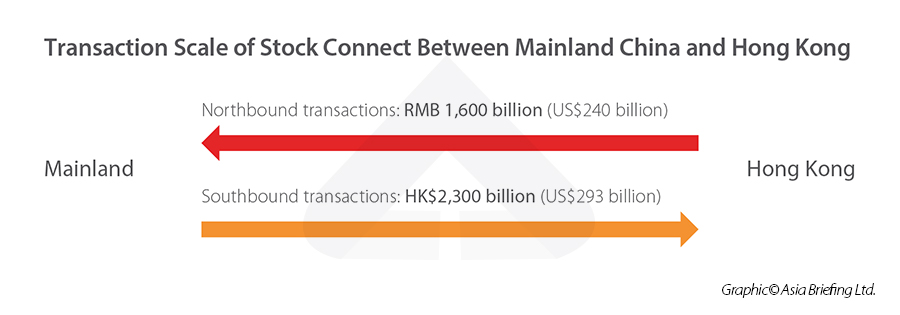

Since the launch of the Stock Connect, the program has brought a net inflow of over RMB 1,600 billion (US$240 billion) to the mainland stock market from HK-based investors (northbound transactions) and over HK$2,300 billion (US$293 billion) to the Hong Kong stock market from mainland investors (southbound transactions). The amount of foreign holdings of mainland onshore bonds has reached over RMB 3,700 billion (US$554.94 billion).

In 2019, China launched another Stock Connect program that links the Shanghai Stock Exchange with the London Stock Exchange. In 2021, China expanded the Shanghai-London Stock Connect program to include companies listed on the Shenzhen Stock Exchange, as well as Swiss and German stock exchanges.

Further expanding “Stock Connect,” the “ETF Connect” mechanism was first proposed in 2016. An ETF is a basket of securities that are listed on an exchange, such as stocks and bonds. It gives investors the indirect ownership of every stock it holds, offering exposure to a sector or index without the investor having to buy the underlying assets.

The ETF Connect allows more offshore investors to invest in China’s specific industries and permits mainlanders to invest in ETFs holding secondary listings in Hong Kong, such as Alibaba and Baidu. This effort is expected to stimulate investments in mainland stock markets and ease the capital outflows to counter a devalued RMB.

Hong Kong, an attractive hub for international investments, holds a critical status in China’s financial development. In its 14th Five-Year Plan (FYP), the central government indicated staunch support for enhancing Hong Kong’s function as a global offshore RMB business hub to connect the Chinese Mainland’s financial market with the world. Former Hong Kong Chief Executive Carrie Lam welcomed the implementation of the “ETF Connect,” as the program will bolster investors’ confidence in both markets.

Hong Kong is not the sole partner for China’s ETF scheme. South Korea and Singapore have also expressed support for the ETF Connect schemes, respectively.

What kind of ETFs are eligible for the ETF Connect?

The inclusion of eligible ETFs is based on a few factors, including fund size, turnover, and the index track. According to the bourses, eligible mainland ETFs should have an average daily asset of more than RMB 1.5 billion (US$223 million) over the previous six months while an average of HK$1.7 billion (US$217 million) is required for eligible Hong Kong ETFs.

| Eligibility for the ETF Connect | |

| Mainland ETFs | Hong Kong ETFs |

| Average daily assets of more than 1.5 billion yuan (US$223 million) | Average daily asset value of HK$1.7 billion (US$217 million) |

Under the ETF Connect, investors may trade ETFs only on secondary markets and no subscriptions or redemptions are allowed. Domestic investors in mainland can invest through the qualified domestic institutional investor (QDII) program while offshore investors can tap mainland ETFs via the qualified foreign institutional investor (QFII) program. No synthetic ETFs or leveraged and inverse products will be permitted, and the benchmark used must have been launched for at least one year.

What is the standing of stock markets in the Chinese Mainland and Hong Kong?

In April 2022, financial bond issuance stood at RMB 769.32 billion (US$115.86 billion) while the outstanding bonds held in custody hit RMB 138.2 trillion (US$20.8 trillion), according to the data from the People’s Bank of China (PBOC). A total of 1,035 foreign institutional investors entered China’s bond market with debt holdings of RMB 3.9 trillion (US$587 billion). Meanwhile, China-focused equity ETFs garnered a net RMB 114.87 billion (US$17.3 billion) inflow this quarter, the most among emerging markets. The recent ease of the crackdown on the tech sector may also revive confidence in China’s stock.

As for Hong Kong, the city’s total market capitalization of 153 listed products, including inverse and leveraged funds, reached HK$429 billion (US$54.68 billion) in 2021, with a range of thematic products focusing on technology and ESG. Since the end of this February, 60 equity ETFs tracking the city’s indexes have added HK$34.52 billion (US$4.4 billion). Such increase of capital suggests investors are optimistic about Hong Kong’s market outlook.

What is the future outlook of ETF Connect?

The launch of the ETF Connect program will add more capital to the onshore and offshore ETF markets in both mainland and Hong Kong – further diversifying investor profiles and improving the liquidity and stability of the financial market. As the trading cost of ETFs is lower than trading stocks, the Connect will attract more institutional investors to find an extra avenue for cross-border investment.

The exchange market features some assets, such as enterprise asset-backed securities, which aren’t traded on the interbank market. Securities commentators say that main indexes, such as the Hang Seng Index, Hang Seng China Enterprise Index, and Hang Seng Tech Index, will be selected in the first batch to be included in the program, while other funds, such as the Tracker Fund of Hong Kong, Global X Hang Seng High Dividend Yield ETF, and the Ping An of China CSI HK Dividend ETF, may be added later.

Despite the promising outlook, some have voiced concerns over the long delays of the program, anticipating waning enthusiasm from investors. Complications over operational procedures may also deter some interest. The initial investment limitation of the ETF Connect offers investors across the borders little beyond what they can already access via existing products from local firms.

That said, though the scope of the ETF Connect may look narrow at first, eligibility criteria are expected to be relaxed as the program progresses, after the government has “tested the waters.”

China’s continuous efforts to open its financial market

On May 27, 2022, the same day as the announcement of the ETF Connect, China indicated it would further facilitate foreign investments in its bond market and coordinate the opening-up of the interbank and exchange bond markets, in a joint statement released by PBOC, CSRC, and the State Administration of Foreign Exchange. The new regulations, effective from June 30, will allow qualified foreign institutional investors, namely central banks, sovereign funds, commercial banks, and pension funds, to invest in bonds on the exchange market.

Currently, the country already allows more than 1,000 foreign institutional investors to trade directly in its centralized interbank bond market, which accounts for about 90 percent of the country’s RMB 138 trillion (US$20.6 trillion) worth of onshore debt. The reforms target the remaining 10 percent of China’s onshore market.

Facing a gradual slowdown, China’s economy needs to tackle many challenges. In April 2022, the offshore RMB fell 1.5 percent against the dollar its biggest weekly drop since 2020. In late May, Premier Li Keqiang asked officials to move decisively to “prevent the economy from backsliding.”

The ETF Connect and more opening-up of the financial market will likely reignite global interest in China’s economy to certain extent.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Belt and Road Weekly Investor Intelligence #84

- Next Article China’s VAT Rebates Policy: Eligibility, Timeline, and Procedures