What to Expect from the 2024 Two Sessions – GDP Growth Target and Policy Agenda

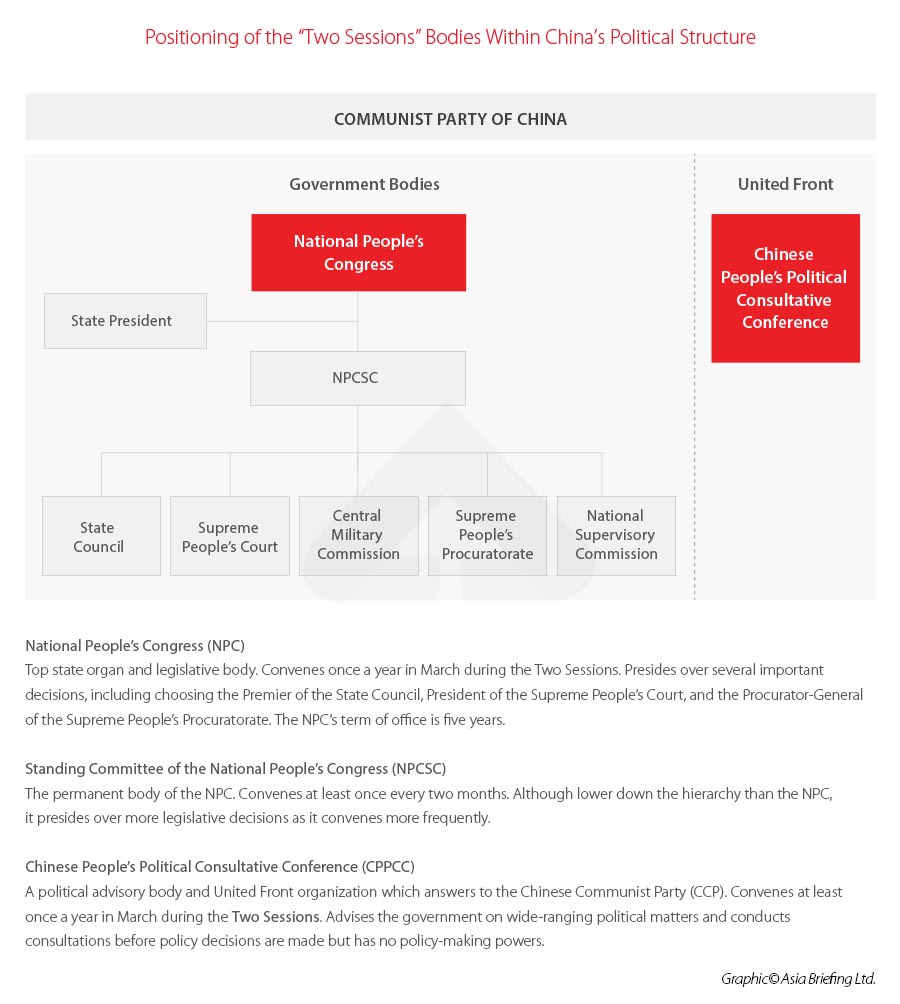

China’s 2024 Two Sessions will begin on Monday, March 4, with the convening of the 14th Committee of the Chinese People’s Political Consultative Conference (CPPCC), the country’s top political advisory body. The 14th National People’s Congress (NPC), China’s legislature, will convene and commence meetings on March 5.

The Two Sessions are China’s most important annual political meetings, during which Chinese Premier Li Qiang will deliver the annual Government Work Report (GWR), the country’s overarching economic and social development blueprint for the coming year.

In this article, we look at what may be revealed during the 2024 Two Sessions and discuss their significance for foreign businesses and investors in China.

2024 GDP growth target

One of the main aspects of the GWR is setting the annual GDP growth target. In 2023, the GWR set a growth target of “around 5 percent”, which was exceeded thanks to high growth in the second and fourth quarters in particular. GDP in 2023 grew 5.2 percent from 2022.

Many analysts believe that China will set a similar growth target for 2024, as the government will seek to galvanize local governments to pour resources into stimulating growth. The average growth target of regional governments, released in January, is 5.4 percent, indicating that local governments are already planning for a growth-focused year ahead. The national GDP growth target is usually set slightly below that of the provincial average (in 2023, the average regional GDP growth target was 5.6 percent).

Meanwhile, third-party analysts’ GDP growth forecasts range from around 4.5 to 5 percent, with the IMF predicting a 4.6 percent increase and JPMorgan predicting a 4.9 percent increase.

However, it is still uncertain whether the government will set the growth target at 5 percent, as growing at this rate may not be as easy in 2024 as it was in 2023. The relatively strong performance of the Chinese economy in 2023 creates a high base effect, which means the economy will need to maintain its upward trajectory if it is to maintain a similar growth rate as in 2023. (By contrast, GDP growth in 2022 slowed to just 3 percent year-on-year, which made hitting the 5.2 percent growth rate in 2023 considerably more likely).

This does not mean that the government will necessarily shy away from setting a more ambitious growth target, rather it means a higher growth target will likely come with more direct efforts and policy measures to stimulate the economy. Should the GDP target be set at around 5 percent, it is also likely that the GWR will announce complementary fiscal policy and stimulus measures to ensure the country can reach this target.

Economic policy in 2024

Since lifting COVID-19 restrictions a year ago, China has experienced a year of uneven but steady recovery. While sectors such as manufacturing and services recorded rapid rebounds as life and work returned to normal, recovery in other areas of the economy has been more sluggish. Consumption, while showing a strong recovery in the second quarter, stagnated in the latter half of the year amid weak domestic demand, evidenced by slowing growth in retail sales in the final quarter and low levels of inflation.

Meanwhile, foreign direct investment (FDI) inflows fell by 8 percent year-on-year, while foreign trade slowed to just 0.2 percent year-on-year growth.

If the Chinese government is to set a more ambitious growth target of around 5 percent, we are likely to see measures and proposals in the GWR that tackle some of these issues.

The 2023 Central Economic Work Conference (CEWC), held from December 11 to 12, provides another clue as to the direction of China’s economic policy in 2024. The annual CEWC sets the economic agenda for the coming year, and for 2024, the agenda is focused on maintaining the trajectory of recovery through measures such as boosting domestic demand, “moderately intensifying” proactive fiscal policy, implementing reforms of the tax and fiscal systems, expanding market access in key sectors, and stabilizing the financial markets, among others.

In recent years, the GWR has also set quotas for various fiscal tools and bonds that are used to fund local governments. This includes setting the annual quota for local government special purpose bonds (SPBs), which local governments can use to finance local initiatives, in particular infrastructure projects. This is a key tool for boosting local economic growth, and one of the few methods for transferring funds from the central government to local governments.

The 2023 SPB was set at RMB 3.8 trillion (approx. US$549.2 billion), up from RMB 3.65 trillion (approx. US$527.5 billion) in 2022. The government can front-load around 40 to 60 percent of the SPB quota before the release of the GWR to ensure funding is not interrupted in January and February of each year. In the first two months of the year, local government budgets revealed a front-loaded SPB quota of RMB 2.28 trillion, 60 percent of the 2023 quota.

The question also remains whether the government will announce any further stimulus measures to boost growth. In the face of uneven growth throughout 2023, there were numerous calls for more stimulus from the central government. The government also hinted at the possibility of the implementation of policy measures, however, no stimulus package was ultimately announced. Some other measures were implemented, however, such as the issuance of RMB 1 trillion (approx. US$137.4 billion) in special treasury bonds (STBs)

STBs are another type of treasury bond similar to SPBs, but which are normally used for national strategic purposes, in this case, disaster prevention and relief. The GWR may announce the issuance of STB or another type of treasury bond to enhance economic stimulus in 2024.

Other potential tools that the government could employ include further extensions of preferential tax treatment and fee reductions.

Measures to boost demand and improve the business environment

We expect a portion of the GWR to be dedicated to discussing improving the weaker areas of the economy, in particular boosting domestic demand and improving the business environment to increase foreign investment and trade.

In 2023, the GWR proposed to stimulate domestic demand by increasing investment in industries and society as a whole, rather than implementing specific consumption-stimulating policies. In the past, the government has provided various incentives to stimulate the consumption of specific goods, such as automobiles and home appliances.

It is possible that this year, the GWR will announce more direct measures to stimulate consumption, however, it is still more likely that similar indirect measures such as efforts to increase household income and stabilize the housing market to regain consumer confidence.

Similar proposals were named in the 2023 GWR, which called for “increasing the income of urban and rural residents through multiple channels”, with the hope that more disposable income will lead to higher levels of consumption.

Meanwhile, improving business confidence was high on the policy agenda in 2023, and will continue to remain so in the coming year.

Although the 2023 GWR called for attracting and utilizing more foreign capital in 2023, however, as we have seen, foreign investment in China plummeted.

The government has already taken measures to tackle the drop in foreign investment in 2023, releasing various policy documents to boost business confidence and attract foreign investment. These include guidelines released in August that proposed a variety of measures to improve conditions for foreign companies, including improving foreign participation in government procurement, improving intellectual property rights protection, and ensuring equal access and treatment with regard to policy initiatives.

Certain measures have already been proposed that would improve conditions for foreign companies, such as draft measures to facilitate cross-border data flows, as well as new visa policies facilitating business travel.

While the GWR this year may not announce any specific policy measures to boost foreign investment, we expect that it will propose measures to be implemented to improve market access and create a more even playing field for foreign companies in China. These calls would then act as a directive to the responsible government departments, as well as local governments, to formulate and implement concrete plans to attract foreign capital and boost the confidence of foreign companies.

The 2023 CEWC has already made similar proposals, calling for relaxing market access in service industries such as telecommunications and healthcare, addressing issues surrounding cross-border data flows and government procurement, and making it easier for foreigners to obtain visas to China for business, study, and tourism.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates also has offices in Vietnam, Indonesia, Singapore, United States, Australia, Germany, Italy, India, and Dubai (UAE). We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Dairy Industry – Market Trends and Opportunities

- Next Article China Sets 2024 GDP Growth Target at “Around 5%”: Key Highlights from the Two Sessions