Shanghai Implements New Criteria for Permanent Residence Applications from May 1, 2023

Shanghai has introduced some new criteria for permanent residence application starting May 1, 2023. Among others, foreigners who apply for permanent residence as working staff are now subject to higher salary thresholds and stricter non-criminal record requirements. In this article, Fuki Fu, Manager of Human Resources and Payroll Services at Dezan Shira & Associates’ Shanghai office, discusses the latest updates and their potential impact on foreigners’ application for permanent residence in Shanghai.

UPDATE (September 20, 2023): China will issue an upgraded version of the Foreign Permanent Resident ID Card from December 1, 2023, with design improvements and enhanced functionality. Key changes include a new design with a five-star element, advanced security features, an extended 18-digit card number, and increased functionality for managing personal affairs online. The new card does not invalidate the current one, and foreigners with permanent residence status will enjoy benefits like simplified administrative processes and enhanced overall experiences in China.

Shanghai has updated some of its criteria for foreigners’ permanent residence application, which may significantly affect those who plan to apply for permanent residence in Shanghai in the near future.

According to official information given by the Exit-Entry Administration Bureau of Shanghai Public Security Bureau (Shanghai Exit-Entry Bureau), starting May 1, 2023, two important changes have been implemented for the foreigners who apply for permanent residence as working staff (one category of people who are eligible for permanent residence application in Shanghai):

- First, the annual salary and tax payment requirement has been increased.

- Second, a non-criminal record in China is now required, in addition to the non-criminal record in their home countries.

To be noted, the additional non-criminal record requirement is also applicable to most other categories of people who are eligible for permanent residence application in Shanghai.

Below, we introduce these two significant changes and explain their impact on foreigner’s permanent residence application in Shanghai.

Increased salary and tax payment criteria for permanent residence application in Shanghai

According to a recent announcement from the Shanghai Exit-Entry Bureau, foreigners applying for permanent residency as working staff must meet new requirements. They must have worked in Shanghai for the past four years, stayed in mainland China for at least six months every year, earned no less than six times the average annual salary of urban employees in the previous year in the region for four consecutive years, and paid an annual individual income tax (IIT) of not less than 20 percent of their salary, in addition to other standard requirements, such as good health, compliance with Chinese law, and no criminal record.

Previously, applicants were required to have an annual pre-tax salary income exceeding RMB 600,000 (approximately US$94,000) and an annual IIT payment of no less than RMB 120,000 (approximately US$18,800).

For comparative purposes, we state the old and new salary and tax payment criteria in the below table:

| Comparison of Old and New Salary and Tax Payment Criteria for Permanent Resident Application in Shanghai (Working Staff) | ||

| Annual taxable income (ATI) | Tax base | CIT rate |

| Annual salary income | Exceeding RMB600,000 | No less than six times the average annual salary of urban employees in the previous year in the region |

| Annual IIT payment | Exceeding RMB120,000 | No less than 20 percent of their salary |

As of May 9, 2023, the Shanghai Exit-Entry Bureau has not yet provided detailed information regarding the salary and tax payment requirements for the new permanent residence application criteria. However, based on the average annual salary data released by the Shanghai Human Resources Bureau over the past four years, it is evident that the new salary criteria are significantly higher than the previous requirement of RMB 600,000 (approx. US$94,000) per year.

To qualify, foreigners applying for permanent residence as working staff after May 1, 2022, must have earned a certain minimum annual income for each of the previous four years, as indicated in the chart below. The total of these annual incomes should be approximately 20 percent higher than the previous salary criteria. Additionally, applicants must pay an annual individual income tax (IIT) equal to at least 20 percent of their annual salary base. This IIT requirement is also higher than the previous criteria of RMB 12,000.

The new criteria are expected to make it more difficult for many applicants to qualify for permanent residence, particularly those whose income is near the threshold.

| New Annual Salary and IIT Criteria for Permanent Residence Application as Working Staff in Shanghai 2023 | ||||

| Year | Valid period | Average monthly salary of previous year (RMB) | Six times of average monthly salary* (RMB) |

New annual salary criteria for permanent residence application (RMB) |

| 2019 | 2019.7-2020.6 | 8,765.00 | 52,590.00 | 631,080.00 |

| 2020 | 2020.7-2021.6 | 9,580.00 | 57,480.00 | 689,760.00 |

| 2021 | 2021.7-2022.6 | 10,338.00 | 62,028.00 |

744,336.00 |

| 2022 | 2022.7-2023.6 | 11,396.00 | 68,376.00 |

820,512.00 |

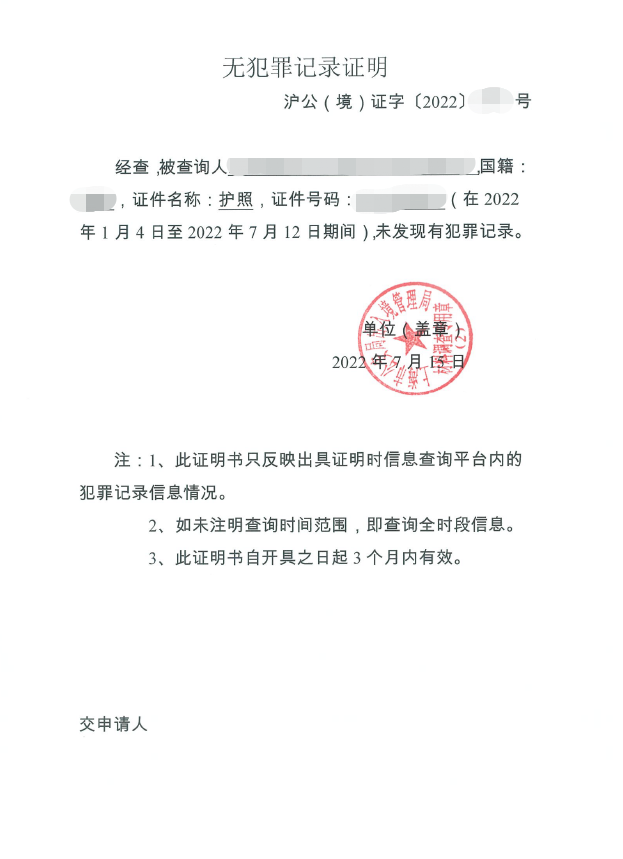

New document requirement of non-criminal record in China

In addition to the new salary and tax payment criteria, the Shanghai Exit-Entry Bureau has implemented another major update to the permanent residence application process.

Starting from May 1, 2023, applicants are now required to submit a non-criminal record in China as part of their application documents. This means that applicants must provide the original and one photocopy of the Certificate of No Criminal Record in China, which should cover all passport numbers used by the applicant during their stay in China.

Previously, applicants were only required to submit a non-criminal record from their passport-issuing country or where they actually lived.

Below is an example of a non-criminal record in China issued by the Shanghai Public Security Bureau. It is important to note that such records are usually only valid for three months from the date of issuance.

Key takeaway

The increased salary and tax payment criteria, as well as the stricter non-criminal record requirements, for foreigners’ permanent residence application as working staff in Shanghai, are expected to make it more challenging for many foreigners to apply for permanent residence in Shanghai. The new document requirement will add to the burden of the applicants as they now have one more document to deal with.

However, the old criteria will still apply to foreigners who submitted their application before May 1, 2023. They do not need to wait for another few years to meet the new salary and tax payment thresholds.

For foreigners who plan to apply for permanent residence after May 1, 2023, they will need to fulfill the new requirements as introduced in this article. If they are unsure whether their salary and tax payment situation satisfies the new criteria, it is suggested they consult with professional services.

Dezan Shira & Associates Human Resources and Payroll team is experienced in permanent residence application in Shanghai, Beijing, Guangzhou, Shenzhen, and other major China cities. For assistance on permanent residence applications, please contact China@dezshira.com

(This article was originally published on May 9, 2023, and last updated on September 20, 2023)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Tax Implications for Chinese Permanent Residence ID Card Holders

- Next Article Challenges and Solutions for European Businesses in China: Insights From the EU Chamber’s Position Paper 2023/2024